Burial insurance coverage is becoming an important financial tool for families in Houston. Funerals are expensive, and without proper planning, the cost can quickly overwhelm loved ones. In Texas, the average funeral can run between seven thousand and twelve thousand dollars. For many households, that amount can disrupt savings or even lead to debt. Burial insurance, often called final expense insurance, is designed to ease this burden. Unlike large life insurance policies that focus on income replacement or estate planning, burial insurance has a single, clear purpose: to cover end-of-life expenses.

For Houston residents, this kind of protection provides more than financial relief. It also provides peace of mind, knowing that loved ones can focus on honoring life instead of worrying about bills. Choosing the best Burial insurance coverage in Houston is not only about comparing prices but also careful thought about family needs, cultural traditions, and the reality of living in one of America’s most populated and fast-growing cities.

Why Burial Insurance Coverage Matters in Houston

Houston is home to over 2.3 million people and is famous for its energy industry, rich culture, and diverse communities. Because of this diversity, funeral traditions in the city vary a lot. While some families choose simple services, others prefer more detailed and grand ceremonies. No matter the type of service, there is always a cost involved, and this expense often becomes the responsibility of the loved ones left behind.

What makes burial insurance useful is how it protects against financial hardship during an already stressful period. A funeral ceremony, body and memorial can cost over $10,000 in Houston. Many households are unprepared to pay for this expense out of pocket. Burial insurance fills that gap. It ensures that burial costs are paid quickly, allowing families to grieve without the added burden of financial commitments.

Burial Insurance vs. Life Insurance

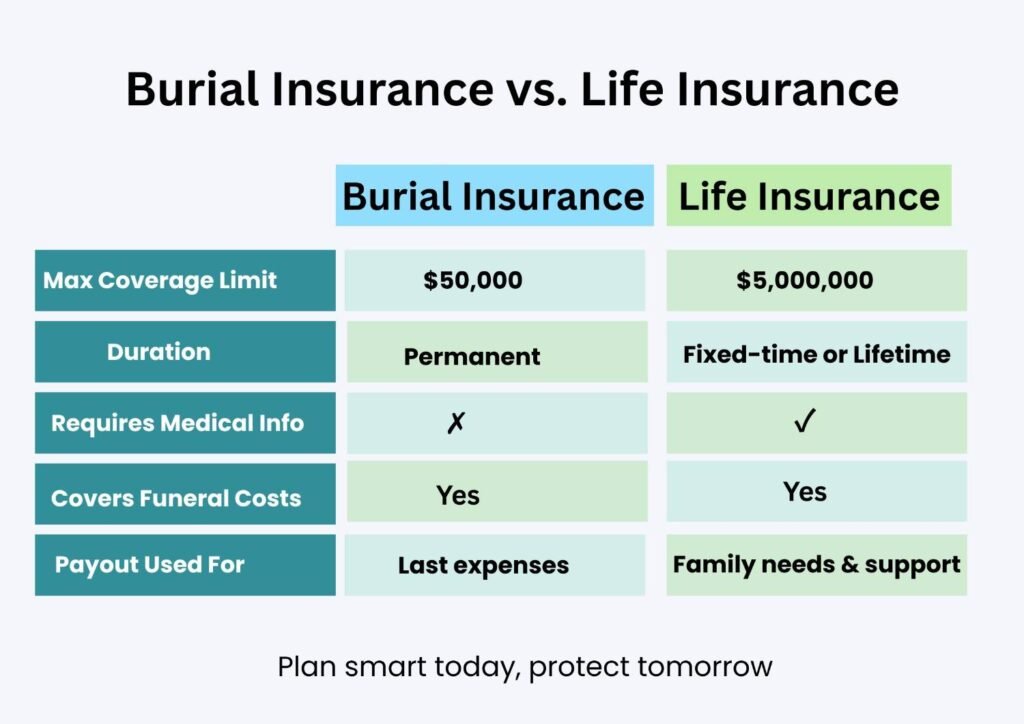

One of the most common misunderstandings in Houston is assuming that burial insurance and life insurance are the same. While both provide financial protection, they serve different purposes.

Life insurance

Life insurance is usually purchased to cover long-term responsibilities such as paying off a mortgage, replacing lost income, or leaving behind an inheritance. These policies can be large, with benefits reaching into the hundreds of thousands or even millions of dollars.

Burial insurance

Burial insurance, on the other hand, is much smaller and more focused. Policies typically range from $5000 to $25000. The benefit is meant to handle funeral bills, medical expenses left unpaid, and other immediate costs after death. For many Houston families, especially seniors or those living on fixed incomes, this is a practical solution.

The Cost of Burial Insurance in Houston

To understand why burial insurance is important, it helps to look closely at the actual expenses families face in Houston.

Funeral and Burial Costs in Houston 2025 (Approx.)

| Expense Category | Estimated Cost Range |

| Basic Burial Service Fee | Around $2,000 |

| Casket (simple to premium) | $2,500 – $7,000+ |

| Body Preparation & Balancing | $700 – $1,200 |

| Basic Cemetery Plot | $1,000 – $4,000 |

| Burial Stone | $1,200 – $3,000 |

| Flowers, Transport & Obituary | $500 – $1,200 |

When added together, these costs can be significant. Many families underestimate the full amount until they are confronted with it. Burial insurance ensures that money is available immediately to cover these expenses, which helps prevent financial strain during an already challenging moment.

Types of Burial Insurance Policies Available in Houston

When searching for burial insurance coverage in Houston, residents generally find two main types of policies.

Simplified Issue Insurance – Which does not require a medical exam but does ask a few health-related questions. Approval is often quick, making it a good option for seniors or those with some health concerns.

Guaranteed Issue Insurance – It requires no medical questions at all and accepts nearly everyone. Because of the higher risk to the insurer, premiums are often higher and there may be a waiting period, usually two years, before the full benefit is available.

Both options are widely available in Houston and provide flexibility depending on personal health and budget.

Who Benefits Most from Burial Insurance Coverage in Houston

While burial insurance is available to anyone, certain groups in Houston benefit the most. Seniors who do not already have life insurance often use it as an affordable way to ensure that their final expenses are covered. Families with limited savings may also find it helpful, since even a small policy can relieve financial pressure.

If someone has health problems and cannot get a big life insurance policy, burial insurance can be a good option for a person because the application is much easier. Some families that follow strong cultural or religious traditions also prefer this type of coverage. In a populated city like Houston, funeral practices are very different from one family to another. Having burial insurance makes sure there is money set aside so these important customs can be honored without creating financial stress.

Factors Houston Residents Should Consider Before Choosing a Policy

Choosing the best burial insurance coverage in Houston involves more than picking a company at random. Many factors deserve close attention. The coverage amount should reflect the actual cost of funeral services in the city. A policy that is too small may leave gaps, while one that is too large could result in unnecessary premiums.

When choosing burial insurance, one of the first things to consider is cost. The monthly payment should be easily affordable for the entire family. It is important to choose a reputable company for families that want to trust that claims will be paid shortly. Some insurance providers also allow you to choose how to use the refund, which is useful when your expenses surpass the cost of the funeral. Age and health are other important factors—the younger and healthier you are at the time of application, the less you will typically pay. That is why applying early often results in lower rates and longer-term savings.

Common Mistakes When Buying Burial Insurance Coverage

Houston residents sometimes make errors when purchasing burial insurance. One of the most frequent mistakes is choosing a policy solely based on the lowest monthly premium. While price is important, the policy must provide enough coverage to handle actual funeral costs in the city. Another mistake is failing to read the exclusions. Some policies may not pay out under specific conditions, which can cause problems later.

Inflation is another overlooked factor. Funeral expenses rise over time, and a policy bought ten years ago may not be enough today. Waiting too long to purchase coverage also increases premiums and limits options. Addressing these issues early helps families avoid unpleasant surprises.

The Role of Culture and Tradition in Houston Funerals

Houston is one of the largest cities in the United States, and its diversity is clear in the way families hold funerals. Every community has its own culture and traditions that influence how people remember their loved ones. In Houston, funerals are not only a time to say goodbye but also a way to show respect, love, and togetherness in special ways.

Vietnamese and Chinese families in Houston may follow basic spiritual beliefs and cultural traditions. Some families use unique rituals or prayers to guide the soul of a loved one. These practices bring comfort and help in protecting cultural values, even among younger generations growing up in America.

For families planning a service, understanding these cultural traditions can make the process more personal and respectful. Funeral homes in Houston are often familiar with these customs and can help guide families through their cultural and spiritual needs.

Each of these traditions carries costs, from extended services to ceremonial items. Burial insurance allows families to honour their cultural practices without worrying about financial limitations. For a city like Houston, where cultural expression is strong, this aspect of burial insurance is especially meaningful.

Burial Insurance for Seniors in Houston

Seniors represent the largest group purchasing burial insurance in Houston. Many are retired and living on fixed incomes, which makes affordability critical. Traditional life insurance may no longer be accessible due to age or health, but burial insurance provides a simple alternative.

Policies are often available up to age eighty-five or even ninety, which means seniors can still secure coverage later in life. For many, this brings peace of mind, knowing their children or grandchildren will not be left with final expenses.

Choosing Reliable Providers in Houston

Not all insurance companies are the same. People in Houston should think about the company’s reputation before making decisions. A strong financial rating from agencies like A.M. shows how trustworthy an insurance company is for paying claims, and they provide better services for any individual person. You check and determine if customer service is important, especially when families require additional and caring support during a difficult time.

Local presence can make a difference too. Companies or agents who understand Houston’s community and cultural needs often provide more personal support. Reviewing policy details, claim processes, and customer feedback helps families choose wisely.

How Burial Insurance Fits into a Larger Financial Plan

Burial insurance is one piece of a broader financial picture. In Houston, many families use it alongside retirement savings, health savings accounts, and traditional life insurance. It can also connect with estate planning by ensuring that wills and legacies are carried out smoothly.

While burial insurance only covers last expenses, combining it with other financial tools provides a fuller safety net. Families gain both immediate protection and long-term stability.

Questions to Ask Before Buying a Policy

- How much coverage do I really need?

- Will the premium stay the same for life, or can it increase later?

- Is there a waiting period before full benefits are available?

- Can the payout be used for other costs, like debts or medical bills, not just the funeral?

- What happens if I miss a payment?

By asking these questions in advance, families can avoid problems later and make sure the policy truly meets their needs.

The Future of Burial Insurance in Houston

The population of Houston is both rising and older, which means burial insurance will be in high demand. As funeral costs rise, many families regard burial insurance as an important part of financial planning. Seniors continue to be the primary market, but younger persons, particularly those caring for aging parents, are also taking into account policies.

This shift reflects a larger cultural awareness in Houston—planning ahead is an act of love and responsibility. It ensures that family members are not left struggling when the time comes.

Final Thoughts on Burial Insurance in Houston

Burial insurance coverage in Houston provides more than financial support. It provides peace of mind and cultural respect. With funeral costs steadily rising and traditions as diverse as the city itself, this type of insurance allows families to focus on a better life rather than worrying about money.

Choosing the best policy means looking at more than just the premium. It requires balancing affordability, coverage amount, company reputation, and personal needs. For Houston residents, burial insurance is not just another product; it is a thoughtful decision that reflects care for loved ones.

Insurance Centrik is to provide clear information that helps families make confident choices. Burial insurance may not prevent loss, but it prevents unnecessary hardship. In a city as vibrant and diverse as Houston, preparing for the future is one of the strongest ways to show love and responsibility to the people who matter most.