Pets are like family. They make us happy, stay with us through ups and downs, and deserve the best care possible. In a busy and costly city like Los Angeles, taking care of pets can become expensive, especially when they fall sick or get injured. This is where Pet insurance in Los Angeles helps. It can reduce the stress of high vet bills and make sure your furry friend gets the right medical care without delay.

Why Pet Insurance Is a Smart Move in Los Angeles

Choosing the best pet insurance is not easy. Every company provides different types of plans, prices, and coverage. Some include regular checkups, while others only cover accidents or serious illnesses. To help you make the right choice, let’s look at what you should know before buying pet insurance and how to choose the best one for your pet’s needs.

Los Angeles is home to some of the best veterinary hospitals and clinics in the country. But those services come with high bills. Treatments for serious health issues or emergency visits can easily reach several thousand dollars.

If you have insurance, you can easily handle those expenses without stress. You don’t have to decide between your savings and your pet’s health, the insurance takes care of the heavy cost while you focus on care and comfort.

Know What Your Pet Really Needs

Before buying any insurance plan, take a good look at your pet’s lifestyle. A young, healthy puppy may not need the same level of coverage as an older dog or a cat prone to allergies.

Think about your pet’s habits — are they adventurous and active, or calm and home-loving? Active pets are more likely to face accidents or injuries. On the other hand, older pets might need long-term medical care.

If your pet has a known hereditary condition, make sure the plan covers it. Some breeds, like bulldogs or Persian cats, are more likely to develop breathing or joint problems. Tailoring coverage to your pet’s life is the first step toward choosing wisely.

Types of Pet Insurance Plans

Most insurance companies in Los Angeles offer three common types of pet insurance:

- Accident-Only Coverage – Covers injuries from unexpected accidents like fractures, burns, or animal bites.

- Accident and Illness Coverage – Covers accidents plus health problems like infections, allergies, or chronic diseases.

- Comprehensive Coverage – Includes everything above, plus routine checkups, vaccinations, and preventive treatments.

If you’re new to pet insurance, accident and illness coverage is usually the best balance between protection and price.

Coverage Details That Truly Matter

Every insurance plan has its own coverage limits and exclusions. Reading the policy carefully is essential. Many owners skip the fine print and regret it later when they discover that certain treatments aren’t covered.

Look for plans that include diagnostic tests, surgeries, medications, X-rays, and hospital stays. Some even include dental care or behavioral therapy. Check for exclusions too — pre-existing illnesses, cosmetic surgeries, and pregnancy-related expenses are often not included.

The best coverage is one that gives maximum value without unnecessary extras you’ll never use.

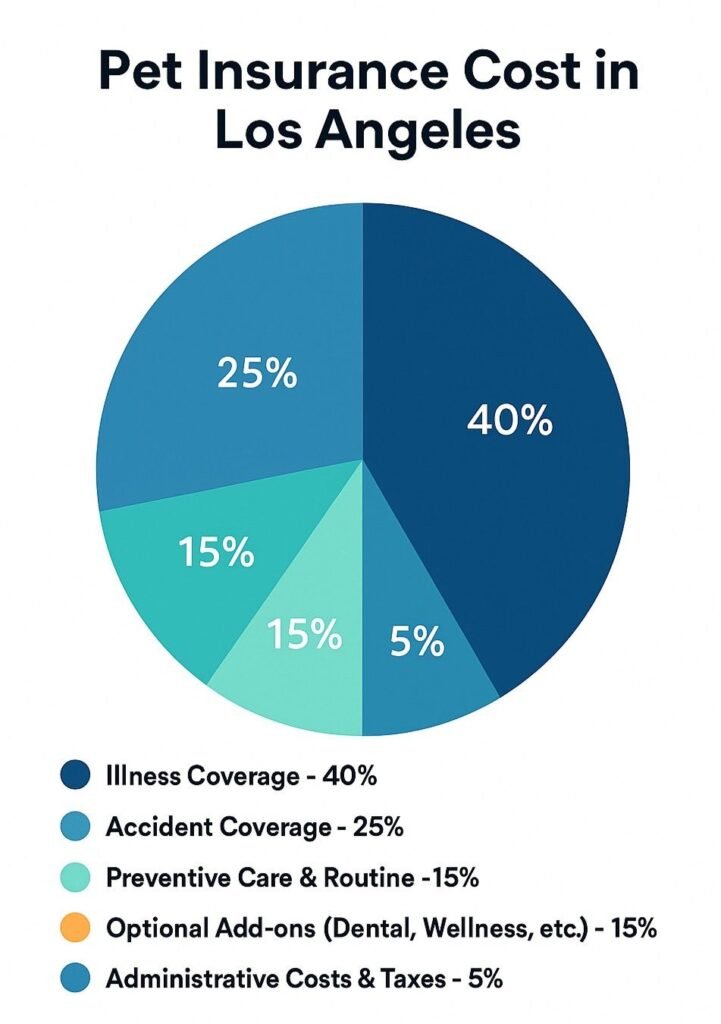

How Much Does Pet Insurance Cost in Los Angeles?

The cost depends on your pet’s breed, age, and health. On average, monthly premiums range from $25 to $90. Small breeds or younger pets usually cost less, while larger or older pets cost more.

Here’s what influences the price:

- Older pets are more expensive to insure.

- Breeds with known medical risks have higher premiums.

- More coverage equals higher costs.

- A higher deductible can lower your monthly payment.

In short, choose a plan you can comfortably maintain each month — not just afford once.

How Reimbursement Works

Unlike human health insurance, pet insurance usually requires you to pay the vet first and then get reimbursed. Once your claim is approved, the company sends back a percentage of your bill.

Most insurers offer reimbursement rates of 70%, 80%, or 90%. Before you finalize a policy, check how long it takes for claims to be processed and whether they offer direct deposit options.

A quick and simple reimbursement process makes all the difference during stressful times.

Customer Reviews Speak Volumes

Before you trust an insurance company with your pet’s health, see what other pet parents say. Honest reviews reveal how the company treats customers — not just how it advertises.

Watch out for complaints about delays in payment, unclear terms, or poor customer service. A company that consistently responds well to claims and questions is usually reliable.

Your pet deserves an insurer that stands by its promises, not one that hides behind paperwork.

The Importance of Vet Access

One of the biggest advantages of good pet insurance is flexibility in choosing your vet. Many companies let you visit any licensed vet in Los Angeles, while others have a limited list.

Since Los Angeles is home to countless specialized clinics, it’s better to choose a plan that gives you freedom. Emergencies don’t wait for business hours — being able to visit any emergency vet clinic without restrictions is vital.

Lifetime vs. Annual Coverage

Some policies reset each year, meaning if your pet develops a long-term illness, it might not be covered in the next policy term. Lifetime coverage, on the other hand, continues to cover your pet’s ongoing conditions year after year.

Though lifetime policies are slightly more expensive, they provide stronger protection for pets with chronic illnesses such as arthritis, diabetes, or heart disease.

Know the Exclusions Before You Sign

Every policy has exclusions, and ignoring them can lead to unpleasant surprises. Most pet insurance plans don’t cover:

- Pre-existing conditions (any illness before coverage started)

- Pregnancy or breeding costs

- Cosmetic surgeries

- Behavior training or grooming

It’s not about finding a plan with no exclusions — it’s about understanding what’s not covered and deciding if you can handle those costs yourself.

Multi-Pet Benefits for Pet Lovers

If you have more than one pet, you can save by choosing a multi-pet policy. Many insurers in Los Angeles offer discounts when you enroll multiple pets under one plan.

This not only saves money but also simplifies paperwork — one renewal date, one monthly bill, and all your pets protected under a single account.

Don’t Ignore Preventive Care

Preventive care is often overlooked but plays a big role in your pet’s long-term health. Vaccinations, flea control, dental cleanings, and yearly checkups may seem minor, but they can prevent bigger health issues later.

Some insurers let you add preventive care as an optional benefit. It’s worth the extra cost if you want your pet’s health monitored regularly. A healthy pet is always a happier one.

Balancing Budget and Benefits

Finding the perfect plan doesn’t mean getting the most expensive one — it means getting the right one for your situation. Make sure the plan fits comfortably within your monthly budget.

If you stretch your finances too thin, you might end up canceling the plan later. Consistency is key; a plan that stays active will protect your pet through every stage of life.

Common Mistakes to Avoid

Many pet owners rush into buying insurance and later realize they missed crucial details. Here are mistakes you should avoid:

- Picking a plan just because it’s cheap

- Not reading the exclusions

- Ignoring waiting periods before coverage starts

- Forgetting to compare reimbursement options

Taking a little extra time now can save you a lot of stress later.

How Pet Owners in Los Angeles Are Adapting

Pet owners in Los Angeles are becoming more health-conscious about their animals. The city’s active lifestyle and warm climate bring both fun and challenges for pets — from outdoor adventures to allergies and heat exposure.

More owners are turning to pet insurance not just for emergencies but also for preventive care. It helps them give their pets consistent care while avoiding financial shocks during sudden medical situations.

Important Questions to Ask the Insurance Company

Before signing any plan, make sure you get clear answers to a few important questions:

- How are premiums decided each year?

- Does the policy cover hereditary or chronic illnesses?

- What’s the waiting period before coverage starts?

- Is there a yearly claim limit?

- Can I visit any vet I choose?

Good companies will answer clearly without hiding behind complicated terms.

Why Research Is the Real Key

There is no one pet insurance company that works best for everyone. The right one is the plan that matches your pet’s needs. Take some time to compare different insurance providers, read what other pet owners say, and understand what each policy covers.

Some plans may seem cheap at first but could limit how much you get back or raise prices after a year. You can find both big insurance brands and smaller local ones in Los Angeles. Always check their claim approval record and customer reviews before making your choice.

When Should You Buy Pet Insurance?

The best time to buy pet insurance is when your pet is young and healthy. Starting early means fewer exclusions, lower premiums, and complete coverage for any new illnesses that may appear later.

Waiting until your pet gets older or falls sick can lead to denied claims because many conditions will be marked as “pre-existing.” Early protection is always smarter than late regret.

How Insurance Centrik Supports Pet Owners

Our goal is to make insurance information simple, helpful, and clear. We understand how confusing pet insurance terms can be, and we believe every pet parent should be able to make decisions confidently. Insurance Centrik goal is to help people and guide them in the right way to buy the most affordable and best insurance plan for their budget.

We don’t sell insurance, we help you make sense of it. By explaining policies in simple language, we aim to give pet owners in Los Angeles the knowledge they need to protect their pets without confusion.

Choosing the best pet insurance in Los Angeles isn’t about finding a “perfect” plan, it’s about finding the right one. Consider your pet’s health, your financial comfort, and the company’s trustworthiness. A good insurance policy won’t just cover bills; it’ll give you peace of mind. It ensures that, no matter what happens, your beloved pet gets care without delay. Your pet gives you endless love, and protecting their health is the best way to return that love. With the right plan, you can give them a safer, healthier, and happier life for years to come.