Choosing health coverage in California is not simple. Premiums, deductibles, doctor access, state rules, and personal health needs all come together at once. The best way to compare health insurance plans is not by looking only at price. You should break each option into parts that affect real life, such as doctor visits, medicines, emergencies, and long term care. When people compare health insurance plans the right way, they avoid surprises and feel confident about what they are paying for.

California has its own healthcare system. Costs change a lot depending on the region. Network rules matter more than many people think. State rules add protection, but they also make things more complicated. A clear comparison process makes this complexity easier to understand and manage.

Why comparison matters more in California

California has one of the most populated healthcare markets in the country. Urban areas offer large provider networks and specialty care. Rural counties may have fewer hospitals and limited in-network options. A plan that works well in Los Angeles may perform poorly in the Central Valley.

When people compare health insurance plans without local context, they often end up with coverage that looks good on paper but fails during use. A proper comparison focuses on how each plan behaves inside California’s healthcare system, not just how it looks in a summary.

Key reasons comparison matters here:

- Provider networks vary by county

- Premium differences can hide high out-of-pocket exposure

- Prescription coverage rules differ across plans

- State rules affect benefits and dispute rights

Start with personal health reality, not plan marketing

Before comparing plans, first of all, you understand your own health needs. Many people look at plan features without thinking about how they actually use healthcare. This often leads to a plan that looks better but does not fit their life.

Think about how many doctor visits you have each year and whether you need ongoing care for any condition. Also check if you take medicines regularly and if you need specialist care often. Knowing this makes it easier to choose the best plan.

When you compare health insurance plans based on real-life use, many wrong options are removed quickly. The best plans will match your needs, not just your budget. This way you can avoid surprises and feel confident about your choice.

How Health Insurance Plan Types Affect Your Coverage in California

Health insurance plans usually fall into a few main categories in California. If you know about the differences early, it helps you choose the best plan and avoid confusion. Each plan type affects how you see doctors, how much you pay, and how easy it is to get care.

- HMO plans – Lower monthly premiums, but you must use doctors in the plan network. You usually need a referral from your primary doctor to see a specialist. Works well if your preferred doctors are in-network.

- PPO plans – Higher monthly premiums, but more freedom to choose doctors and hospitals, even outside the network. Fewer rules for referrals make it easier to see specialists.

- EPO plans – Moderate premiums, but out-of-network care is not covered except in emergencies. Provides a balance between cost and flexibility.

- High deductible plans – Lower monthly cost, but you pay more before the plan starts helping. Can save money if you rarely need care, but can be expensive during medical visits.

When people compare health insurance plans, confusion often happens when they mix these types without understanding how care access rules differ. Understanding plan types first makes comparison much easier.

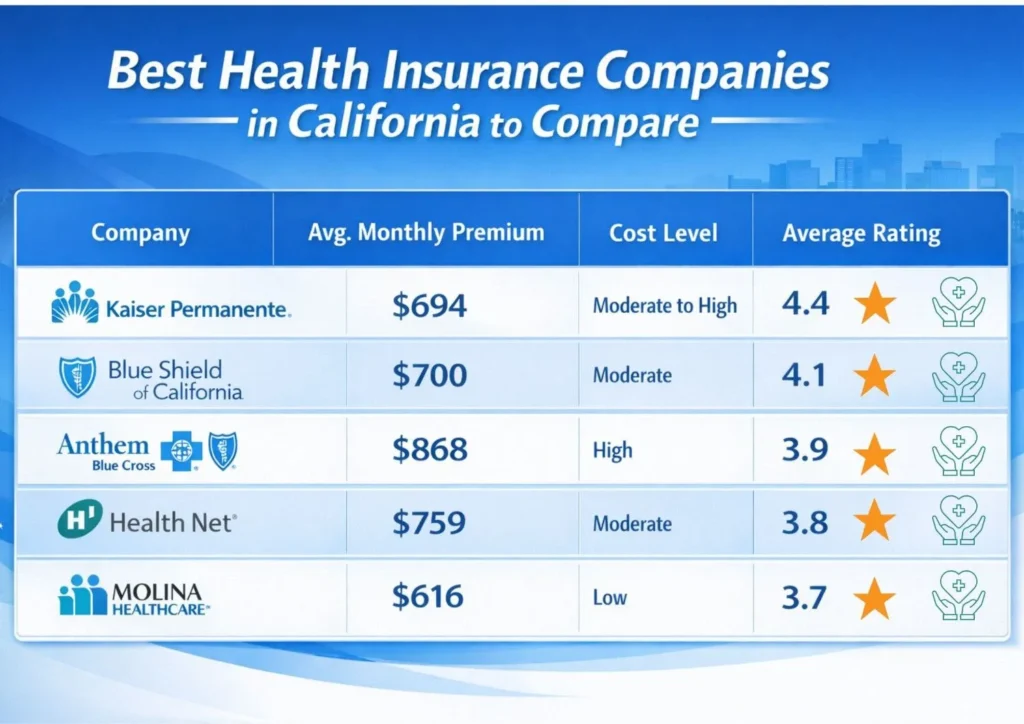

Top Health Insurers in California You Should Compare

When choosing Health Insurance Companies in California, it helps to compare the top insurers side by side. Look for plans that match your doctors, prescription needs, and budget. The best options offer strong networks, clear pricing, and good customer support, so you avoid surprises when you need care.

1. Kaiser Permanente

Kaiser is known for its complete and organized care system. Many people like Kaiser because it makes everything easier under one roof. You can find doctors, labs, and hospitals within the same network. This often makes appointments faster and medical records easier to manage. However, you usually need to use Kaiser doctors and hospitals to get full benefits.

- Easy appointment booking and follow ups

- Simple billing with fewer surprises

- Smooth care coordination between doctors and labs

2. Blue Shield of California

Blue Shield is a popular choice because it provides many plan options and good access to doctors across the state. It works well for people who want a larger network and more flexibility. Blue Shield plans often include many hospitals and specialists, especially in cities. Some people may find the costs a bit higher, but the wider network is a strong benefit.

3. Anthem Blue Cross

Anthem is one of the biggest insurers in California and is known for having a large network. If you want to visit many different doctors and hospitals, Anthem can be a good option. It is also popular for PPO plans, which allow you to see out-of-network doctors in certain cases. Keep in mind that Anthem plans can be more expensive than others, especially if you choose a PPO.

Best for: People who want the most flexibility and access to many providers.

4. Molina Healthcare

Molina is often chosen for its lower cost and focus on basic health services. Many people pick Molina for its affordable plans and strong preventive care. It is mainly known for HMO style plans, which means you need to use in-network doctors. Molina works well for people who want simple coverage without high monthly payments.

5. Health Net

Health Net provides both HMO and PPO plans, giving users more options depending on their needs. It has been in California for many years, so it is well known in the market. Health Net plans may work well for people who want a balance between cost and network access. The most important aspect is the network size, which can vary by region, so it is important to check whether your doctors are included.

key Benefits:

- More plan choices (HMO and PPO)

- Good balance of cost and access

- Strong presence in California

Note:- Premiums are average estimates. Actual costs depend on your county, age, and chosen plan tier.

Why Premiums Alone Don’t Show True Cost

Monthly premiums are the most visible number, but they are not the full cost. Many California residents underestimate how much they will pay out of pocket because those costs happen later, not at signup. To compare plans properly, you must look beyond premiums.

When you compare health insurance plans, you should also check these costs:

- Deductibles – The amount you pay before your insurance starts helping. Higher deductibles mean more money out of pocket early.

- Copayments – A fixed amount you pay for doctor visits or medicine, like $20 per visit.

- Coinsurance – The percentage you pay after deductible, such as 20% of the bill.

- Annual out-of-pocket limit – The maximum amount you pay in a year. After this, insurance covers the rest.

A plan with a low premium can end up costing more if you need regular care. The best way to compare health insurance plans is to estimate yearly costs based on realistic usage, not minimal use.

California Health Insurance Plan Cost Comparison

When you compare health insurance plans, looking at premiums alone is not enough. This cost chart shows typical monthly prices, deductibles, and out-of-pocket limits in California.

Cost Chart for California(Approximate)

| Coverage Level | Monthly Premium | Deductible | Out-of-Pocket Max. |

| Basic Bronze | $320 – $420 | $6,000 – $7,500 | $8,700 |

| Standard Silver | $420 – $550 | $3,000 – $4,500 | $8,200 |

| Enhanced Silver | $350 – $480 | $500 – $2,000 | $6,500 |

| Gold Level | $520 – $680 | $1,000 – $2,000 | $7,000 |

Note:- These cost estimates show that low monthly price does not always mean low total cost. A plan with higher premiums may cost less overall if you use medical care often.

Provider networks decide real-world value

Networks determine which doctors, hospitals, labs, and specialists are accessible without large extra costs. In California, network size and quality vary significantly.

When comparing plans, review:

- Whether primary doctors are in network

- Hospital access within reasonable distance

- Specialist availability without long waits

- Mental health and therapy provider inclusion

Many complaints arise from choosing coverage with limited networks that were not reviewed carefully. The best way to compare health insurance plans includes checking provider directories, not trusting summaries.

Prescription coverage needs special attention

Prescription rules differ widely even when premiums look similar. Formularies define which medications are covered and at what cost level.

When comparing options:

- Check whether current medications are listed

- Review tier placement for each drug

- Confirm prior authorization rules

- Look at mail-order pricing options

California residents managing chronic conditions often find prescription costs outweigh doctor visit costs. Ignoring this area weakens any comparison effort.

Why Deductibles and Timing of Care Matter

A deductible is the amount you must pay before your insurance starts helping. It resets every year, so if you need care early in the year, a high deductible can lead to big expenses right away. This becomes important when you already know you will use medical services soon.

Before choosing a plan, think about the care you expect during the next 12 months. If you have planned procedures, regular tests, or follow-up visits, a high deductible plan may cost you more at the start. On the other hand, if you rarely visit the doctor, a higher deductible might still work if the monthly premium is lower.

Comparing plans based on timing helps you avoid sudden cash flow problems. When you know your medical needs and plan around them, insurance becomes a support system instead of a surprise expense. This way, you stay financially prepared during months when healthcare usage is high.

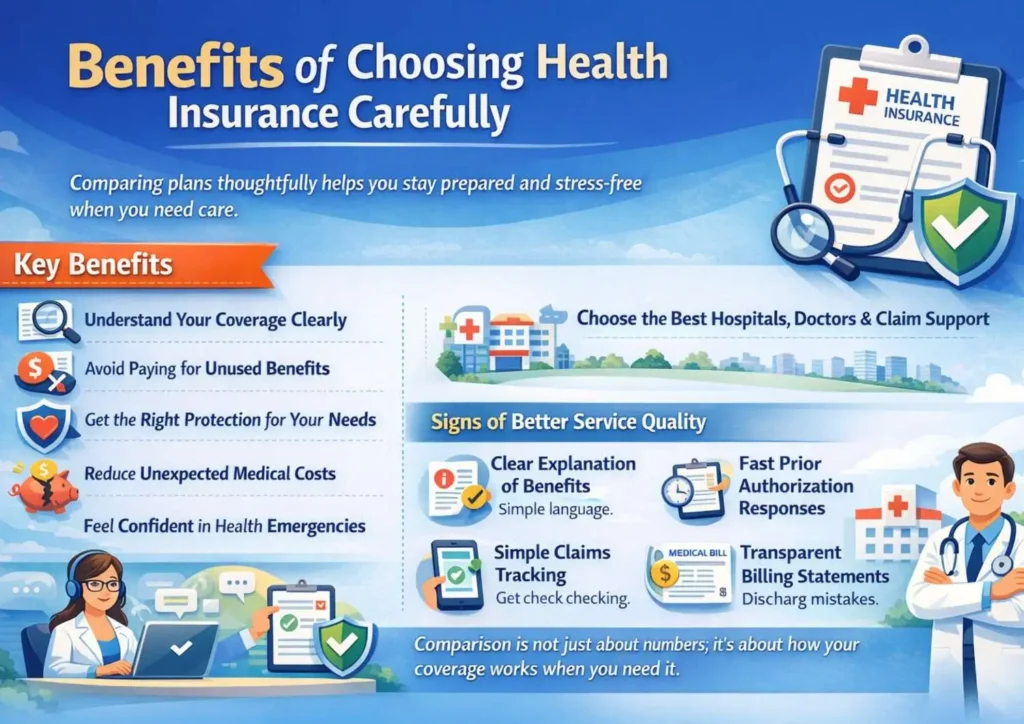

Advantages of Comparing Health Insurance Plans Properly

Comparing plans the right way helps you stay in control. You clearly know what your policy covers and why you chose it. This avoids sudden expenses and stress during medical needs. A good comparison ensures balanced coverage and long-term peace of mind.

Key Benefits

- Clear understanding of coverage

- Avoid paying for unused benefits

- Get protection that truly fits your needs

- Reduce unexpected medical costs

- Feel confident during health emergencies

Taking time to compare plans also helps you choose better hospitals, doctors, and claim support. You can match premiums with your budget and medical needs, making your insurance practical and reliable when you need it most.

Coverage Rules Beyond the Basics

California health insurance plans must cover essential benefits, but the rules are not always the same. Small details inside the policy can make a big difference later. Many limits and conditions are hidden in the fine print, not in the main summary.

Here are some areas you should always review carefully:

1. Maternity and newborn care – Check what tests, hospital stay days, and follow-up visits are covered. Some plans limit post-delivery care or newborn services.

2. Mental health coverage – Look at how many therapy or counseling visits are allowed each year and whether prior approval is needed.

3. Physical therapy limits – Many plans cap the number of sessions, which can be a problem after surgery or injury.

4. Preventive care details – Confirm which screenings, vaccines, and annual checkups are fully covered and which may require copays.

These benefits may not seem important today, but they matter over time. Understanding them now helps you avoid frustration, extra costs, and coverage gaps when you actually need care.

Benefits of Strong Customer Service and Claims Handling

Good coverage has little value if customer service is weak. The way an insurance company manages calls, claims, and approvals shapes your experience every time you use the policy. Delays, unclear answers, or billing mistakes can quickly turn small health issues into major stress. Strong customer support makes healthcare easier to handle, especially during emergencies or long-term treatment.

Key Signs of Better Service Quality

- Clear explanation of benefits – You should easily understand what is covered, what you need to pay, and the reason behind it. Simple wording and clear details help avoid confusion after treatment.

- Simple and easy claims tracking – A reliable plan allows you to track claims online or through an app. You can check each step without calling customer support again and again.

- Fast prior authorization approval process – Many treatments need approval before they start. Quick responses help prevent delays in tests, surgeries, or specialist visits.

- Transparent and easy-to-read billing statements- Bills should clearly show total charges, insurance payments, and your portion. This reduces surprise bills and helps spot errors early.

When comparing health insurance plans, do not focus only on premiums and deductibles. How the insurer supports you during claims and problems matters just as much. Smooth service and clear communication make your coverage dependable when you need it the most.

Common comparison mistakes to avoid

Many Californians repeat the same errors each year.

Frequent mistakes include:

- Choosing lowest premium without cost modeling

- Ignoring network limitations

- Overlooking prescription tiers

- Underestimating deductible impact

- Assuming all plans work the same statewide

Avoiding these mistakes improves outcomes more than chasing discounts.

Practical Method to Compare Health Insurance Plans Effectively

Choosing the right health insurance plan becomes easier when you follow a clear and practical process. Instead of focusing only on price, this method helps you evaluate how a plan will actually work for your medical needs, budget, and long-term care.

A step-by-step comparison keeps your decision realistic and prevents costly mistakes later. It ensures the plan you select supports your health usage, preferred doctors, and financial comfort throughout the year.

- List health needs and usage patterns

- Eliminate incompatible plan types

- Compare total yearly cost, not monthly price

- Verify providers and hospitals

- Review prescription coverage

- Confirm out-of-pocket limits

- Read benefit details for high-use services

This structure keeps decisions grounded in reality.

How Health Insurance Fits Into Smart Financial Planning

Health insurance is not just a medical decision, it is a financial one. Monthly premiums affect your regular budget, while deductibles and copays can impact your savings. Choosing the right plan helps you balance healthcare needs without putting pressure on daily expenses.

A good health plan should match your financial situation. If you have a strong emergency fund, you may handle higher out-of-pocket costs more comfortably. If income is uncertain, a plan with predictable costs can reduce stress and help you stay financially stable.

When coverage matches your comfort with risk, insurance becomes a support system, not a burden. The right comparison turns health insurance into a safety net that protects both your health and your long-term financial goals.

A Clear Path to Smarter Health Insurance Decisions

The best way to compare health insurance plans in California is not fast or flashy. It requires patience, structure, and honesty about real medical and financial needs. Thoughtful comparison replaces guesswork with clarity and helps avoid regret when care is needed.

Insurance Centrik supports this process by providing clear, unbiased information that helps people understand coverage details, costs, networks, and timing. When you compare plans carefully, health insurance becomes easier to understand instead of stressful. That’s the real benefit of taking the time to compare your options.

FAQs

Should I choose an HMO or a PPO in California?

It depends on your needs. PPO plans provide more freedom to choose doctors, but HMOs usually cost less and work well if your doctors are in the network and you are okay with referrals.

How often should I compare health insurance plans in California?

At least once every year during open enrollment. You should also compare plans if your income, family size, or health needs change.

Are Covered California health insurance plans reliable?

Yes. Covered California plans follow state rules. The best plan depends on whether your doctors, medicines, and expected care needs are covered.

Does a higher monthly premium mean better coverage?

Not always. Some higher-priced plans mainly offer convenience. Real value comes from lower out-of-pocket costs and access to doctors you trust.