When you are planning for the future, many people ask whether they should purchase burial insurance or life insurance. The choice depends on personal needs, financial situation, and family priorities. Burial insurance vs life insurance serves different purposes, yet both aim to provide financial support in times of loss. We focus on providing information that helps people make informed decisions without advertising specific products.

Burial insurance is designed primarily to cover funeral and death expenses, while life insurance provides broader financial protection for loved ones, including debts, mortgage payments, and ongoing living expenses. Knowing the differences between the two can help families plan responsibly and avoid unexpected financial burdens.

What is Burial Insurance

Burial insurance, sometimes called funeral insurance, is a type of life insurance policy specifically intended to cover end-of-life costs. It usually has a smaller coverage amount, often ranging from $1,000 to $25,000. The main goal is to ensure that funeral expenses, cemetery costs, and related fees are covered without putting pressure on family members.

Key features of burial insurance include:

- Fixed coverage amounts have the purpose of covering funeral expenses.

- Simplified application process with minimal health requirements.

- Affordable premiums that remain stable over time.

- Quick payout to help family members immediately after passing.

Burial insurance is particularly useful for seniors or people who want to guarantee that their funeral expenses are taken care of, even if they have limited savings or assets.

What is Life Insurance

Life insurance is an important financial product that protects families from income loss if the policyholder dies. Coverage amounts for life insurance can vary greatly, sometimes reaching hundreds of thousands or even millions of dollars. The proceeds can be utilized for various purposes, including as debt repayment, living expenses, education funding, or support for a surviving spouse.

Key features of life insurance include:

- Higher coverage amounts compared to burial insurance.

- Flexible options such as term life or whole life insurance.

- Some policies can slowly grow extra money over time.

- Financial security for dependents over the long term.

While life insurance can cover funeral costs, it is not its sole purpose. It provides comprehensive financial protection for loved ones beyond the immediate expenses of death.

Burial Insurance vs Life Insurance: Key Differences

Understanding the differences is very important to choosing the right policy.

1. Purpose

Burial insurance is designed solely to cover funeral and related expenses. Life insurance provides broad financial protection for family members, including mortgage payments, debts, and ongoing living costs.

2. Coverage Amount

Burial insurance Coverage generally provides smaller coverage, often enough to cover funeral and burial costs. Life insurance can provide much higher coverage, depending on the policy and the insured’s financial needs.

3. Eligibility and Application

Life insurance may require health exams, medical history checks, and underwriting, which can be more complex. Burial insurance often has fewer health requirements and is easier to obtain, especially for seniors.

4. Premiums

Burial insurance premiums are generally lower due to the smaller coverage amount. Life insurance premiums vary widely based on coverage, age, health, and policy type.

5. Payout Speed

Life insurance payments can take longer because the company reviews more details, especially for bigger policies. Burial insurance pays out faster to help with funeral costs right away.

Burial Insurance vs Life Insurance Comparison Table

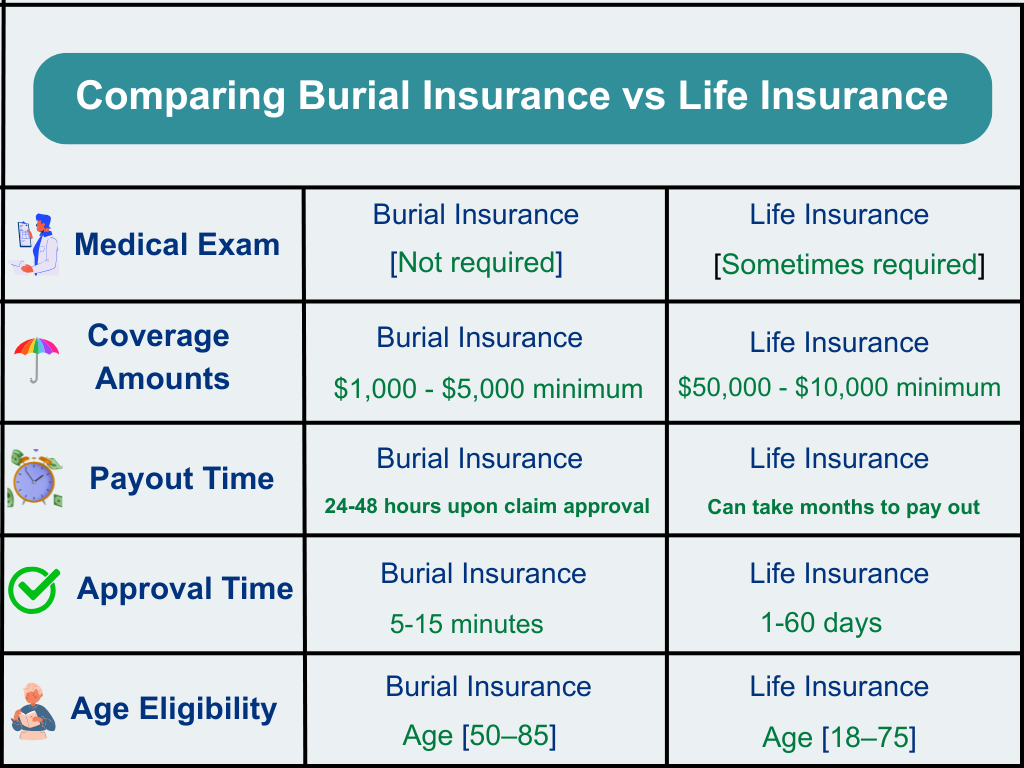

The chart below explains what makes burial insurance different from other life insurance plans.

| Feature | Burial Insurance | Life Insurance |

| Purpose | Covers funeral and end-of-life costs | Provides broader financial protection for loved ones |

| Coverage Amount | $1,000 – $25,000 | $50,000 – $1,000,000+ |

| Application Process | Simple, few health requirements | May require medical exams and underwriting |

| Premiums | Lower, predictable | Varies widely based on coverage, age, and health |

| Payout Speed | Fast, usually immediate for funeral costs | Can take longer, especially for large policies |

| Flexibility | Limited, used only for funeral expenses | High, can be used for any financial need |

| Ideal For | Seniors, those with limited savings, families covering funeral costs | Families needing long-term financial security, mortgage protection, or debt coverage |

Who Should Consider Burial Insurance

Burial insurance is ideal for people who want to guarantee that their final expenses are covered. Typical candidates include:

- Seniors with limited savings.

- People who want a straightforward policy without medical exams.

- Families concerned about covering funeral costs without financial stress.

- Individuals looking for affordable and predictable premiums.

Burial insurance ensures peace of mind, knowing that funeral costs won’t fall on loved ones.

Who Should Consider Life Insurance

Life insurance is best for those who want broader financial protection. It is suitable for:

- Parents or guardians supporting children.

- Spouses who rely on the insured’s income.

- People with mortgages, loans, or significant debts.

- Individuals looking to leave an inheritance or long-term financial security.

Life insurance policies can be tailored to meet specific financial goals and often provide benefits beyond funeral costs.

Common Misconceptions

Many people confuse burial insurance with life insurance or assume one policy covers everything. Some misconceptions include:

- Believing Burial Insurance Provides Full Support — it only covers funeral-related expenses.

- Thinking life insurance is too expensive — there are affordable term policies for all ages.

- Believing you need both — it depends on personal needs, family responsibilities, and finances.

Many people are confused about burial and life insurance. Burial insurance only covers funeral expenses, not full financial support. Life insurance is not always expensive; there are reasonable solutions for all ages. The best option depends on your family’s needs, goals, and financial condition. Therefore, you don’t always need both.

Benefits of Burial Insurance vs Life Insurance

It’s important to understand that the word “life insurance” is extremely expansive. There are various types of life insurance, such as term life, whole life, universal life, and burial insurance.

The main purpose of burial life insurance for seniors is to provide peace of mind by ensuring that if you die, the policy will not leave your family with the financial burden of unpaid funeral expenses.

Below is a table that shows the main differences between burial insurance and life insurance.

This chart gives a clear comparison between burial insurance and life insurance. It explains key differences in medical exams, coverage amounts, payout time, approval time, and age limits. Burial insurance is faster to approve and pays smaller amounts for final expenses, while life insurance offers larger coverage but takes longer to process. It’s a simple guide to help people choose the best type of insurance for their needs and budget.

How to Decide Between Burial Insurance and Life Insurance

Making the right choice depends on your financial situation and family needs:

- If your main concern is covering funeral costs, burial insurance may be sufficient.

- If you want long-term financial security for your family, life insurance is more suitable.

- Consider your age, health, and budget before applying.

- Evaluate what your dependents will need financially after your passing.

Some people choose both policies: burial insurance to cover immediate end-of-life costs and life insurance for broader financial protection.

Choosing the Right Insurance for Your Family

Burial Insurance vs Life Insurance serves different needs, but both offer peace of mind. Burial insurance makes sure funeral costs are covered, so family members aren’t left with unexpected expenses. Life insurance provides broader financial protection, helping loved ones manage debts, living expenses, and future financial needs.If you want to choose the right plan, Insurance Centrik helps people make smart choices. By looking at coverage, costs, and your family’s needs, you can choose the policy that protects your loved ones the most. Planning ahead makes sure your final wishes are followed and your family stays financially secure.